LTC Price Prediction: Assessing Investment Potential Amid Technical Bearishness and Bullish Speculation

#LTC

- Technical indicators show bearish dominance but with weakening momentum

- Conflicting market narratives between short-term caution and long-term optimism

- Price position near Bollinger lower band may attract value buyers

LTC Price Prediction

LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

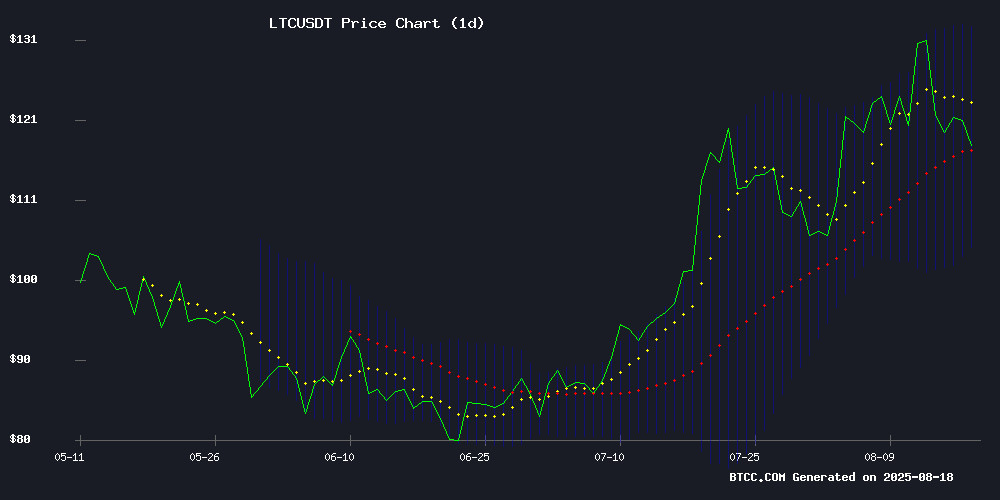

Litecoin (LTC) is currently trading at $116.65, below its 20-day moving average of $118.56, indicating bearish pressure. The MACD histogram remains negative at -0.0090, though the narrowing gap between MACD line (-6.0128) and signal line (-6.0039) suggests weakening downward momentum. Bollinger Bands show price hovering NEAR the lower band ($104.49), potentially signaling oversold conditions.

"The technical setup shows LTC struggling to regain bullish momentum," says BTCC analyst Olivia. "A sustained break above the middle Bollinger Band at $118.56 could signal trend reversal, but until then, caution prevails."

Mixed Sentiment Surrounds Litecoin Amid Market Speculation

Recent headlines present conflicting narratives for Litecoin. While some analysts predict a potential rally to $280, others highlight concerns about decentralization erosion. The "Pepeto Presale" news suggests altcoin rotation may be drawing attention away from established coins like LTC.

"The $280 price target seems overly optimistic given current technicals," comments BTCC's Olivia. "However, Litecoin's steady performance during market uncertainty demonstrates its resilience as a cryptocurrency veteran."

Factors Influencing LTC's Price

Litecoin Holds Steady Amid Market Uncertainty, Analysts Eye $280 Rally

Litecoin (LTC) has dipped below $120, trading at $117.66 with a 2.81% decline over the past 24 hours. The slump aligns with broader crypto market weakness and subdued derivatives activity. Despite the pullback, Litecoin's daily trading volume remains robust at $2.43 billion, with a market capitalization of $9.03 billion.

Technical analysts observe emerging chart patterns resembling Ethereum's historical movements, fueling speculation of a potential rebound. Price targets between $220 and $280 are gaining traction among traders. Litecoin's resilience stems from its established position as a payment-focused asset and strong community backing, which have historically mitigated severe downturns.

Best Crypto to Buy Now: XRP and Litecoin Rally as Pepeto Presale Accelerates

XRP and Litecoin are leading the charge in the crypto market's recovery, with both assets posting significant gains. XRP's momentum builds as regulatory pressures ease, while Litecoin benefits from a surge in mining activity—its difficulty now at a record 97.15 million. Analysts suggest LTC could double to $260 if the trend holds.

Meanwhile, Pepeto (PEPETO) emerges as a dark horse, with its Ethereum-based memecoin presale gaining traction. The project touts zero-fee trading, cross-chain interoperability, and a $0.000000147 entry point, having already raised over $6.2M. Staking rewards promise 243% APY, fueling speculation of a Tier 1 exchange listing.

Litecoin Warns of Vanishing Era for Truly Decentralized Cryptocurrencies

Litecoin issued a stark reminder to the crypto community: the age of genuinely decentralized, fairly launched proof-of-work coins—free from premines, venture capital influence, or borders—has passed. "It's now virtually impossible to replicate the launch conditions of Bitcoin or Litecoin without facing co-option or attacks," the network emphasized. The warning comes as centralization risks escalate across the ecosystem.

Monero's recent 51% attack underscores the vulnerability of smaller PoW chains. On August 12, 2025, the Qubic mining pool hijacked Monero's hash rate, reorganizing blocks and triggering a 13% price plunge. Kraken suspended XMR deposits during the crisis, exposing how even privacy-focused chains with robust technology falter without sufficient decentralization.

While Bitcoin and Litecoin remain bastions of PoW resilience, the incident spotlights growing threats to network security. The market now faces a pivotal choice: embrace the diminishing cohort of battle-tested decentralized assets or navigate the risks of emergent alternatives.

Is LTC a good investment?

Litecoin presents a mixed investment case currently:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $116.65 | Below 20-day MA |

| MACD | -0.0090 | Bearish but weakening |

| Bollinger Bands | $104.49-$132.64 | Near lower band |

"While technicals suggest caution, Litecoin's established network effects and upcoming developments could support long-term value," notes BTCC's Olivia. "Dollar-cost averaging might be preferable to lump-sum investments at current levels."

Technical indicators show bearish dominance but with weakening momentum

Conflicting market narratives between short-term caution and long-term optimism

Price position near Bollinger lower band may attract value buyers